author

Atit Saerepaiboonsub

What are the Earning Differentials between Full-Time Workers in Public and Private Sector who are Bachelor Degree Holder in Thailand? Evidence from Thai Labor Force Survey Data in the Third Quarter of 2022

Abstract

This study wants to investigate the wage gap (wage premium or wage discount) between public and private sector among bachelor degree holder employees in Thailand, especially,

the relationship between individual characteristics and these gap, namely gender, age, region, occupation, education, etc. The size of the public sector wage premium is relatively high in countryside but will change into wage discount in central region. Premium by occupation in public sector can only be found in technician and service worker group, but discount for senior official and professional. In other words, the higher the job position they are in workplace, the higher chance the premium will shift from public sector to private sector. The public sector’s gender wage gap is by far smaller compare to private sector counterpart. Supplementary benefits received in cash such as bonuses, overtime and other cash, are relatively higher in private sector than those in public sector, when taking into account, the size of wage discount for public sector will get bigger. However, it is likely that the discount for public sector could be lower than this estimation alone given that the public sector offers more benefits in term of welfare than the private sector,

and these results do not factor in those non‐pecuniary features of employment,

for example job security, health-care benefits, disability insurance and old-age pension.

Keywords: Wage gap, Wage premium, Wage discount, Public sector, Private sector, Income

1. Introduction

The discussion about what are you going to do after graduation (like what kind of job, which job sector) is quite a popular topic in Thailand to talk about for a long time. In the past, parents play the big role in their children job, they try to encourage their children to apply and get a position in public sector, especially one that leave in the rural area, that what we known as

one of the social norms in Thailand. Things start to change recently as the private sector gain

more percentage in Thai labor market, especially those who are bachelor degree holder which

in Thailand they might have experiences significant educational mismatch among them,

according to Paweenawat, S.W. And Vechbanyongratana, J. (2015). That why it is interesting to see the wage premium between public and private sector in Thailand, because wage is one of the main factors for job selection that young workers seek. The results of this study could be the guideline for young workers or fresh graduate university students, that have to choose in which sector to begin their careers, with different qualifications and or expectations of them.

The main purpose of this paper is to find out the wage premium between full-time workers in public and private sector, who are bachelor degree holder in Thailand using Labor Force Survey (LFS) from National Statistical Office (NSO) in the third quarter of 2022 data. The fact that public sector employees wage has to rely on government policy, and for the bachelor degree level one, the rate not change for a long time. While for the private sector counterpart, it can depend on size of firm or type of firm, and can adjusted for inflation over time. So, we expect private sector employees to earn more in the labor market compare to the public sector one. However, because there is high volatility in private sector employees wage depending on economics situation, so on average the premium might not be much different. To estimate the wage premium, our focus is on the employee, who are a full-time worker (have at least 35 hours of work per week) between the ages of 20 and 59, had a bachelor’s degree as their highest education attainment, and working for public or private sector. We also test whether employees in some occupations (Managers/ Professionals/ Technicians/ Clerical support workers/Service workers) having an advantage if they are working for public sector.

2. Literature review

There are a lot of studies try to find out, whether there is a wage gap between public sector and their private sector counterparts in their countries. Early studies estimated an individual wage (i.e., the natural log of wage) from simple wage functions using observable individual characteristics, such as education and experience as explanatory variables and categorize the different in wage between sectors into various factors, this is called Mincerian wage model (1974). Nevertheless, it is hard to accurately explain the different without taking into account unobserved ability of the individual. Recently most of the empirical studies try to overcome these biases, for example, Chandoevwit, W. (2011) used the ordinary least squares (OLS) and the matching methods to find what professions are better off if they are working for the government. The OLS model is based on Mincer (1974), which dummy variables and interactive terms are added. While the matching method is based on Abadie and Imbens (2002) and Abadie et al. (2004), to estimate the average treatment on treated (ATT). The ATT model can use the average income of government employees with similar characteristics to private sector employees, and estimate the income of the private sector employees.

While one of the objectives of this paper is to try to figure out the gender premium in both public sector and private sector, Bender, (1998) survey review has suggested that, the premium have been falling since the 1990s in the developed countries. For developing countries, the premium for public sector is often negative and could be a large number different. However, jobs working in public sector have the compensation differential and had been considered to be the most secure type of employment one could get, because of healthcare benefits, pensions, better working conditions, etc. This premium is found to be quite vary over the years.

To summarize, several studies have compared the public and private wage premium, and present some evidences on the differences between both sectors. However, in Thai context an empirical analysis on this topic still not much seen, especially for the focus specific group. To present new evidence in Thailand using recent data, this study uses data from the 2022 LFS, to estimate standard wage functions and compare the wage differential of those in the public and private sectors. In this case the study will add to the literature by focusing on a specific group at only one level of education, as from the literature and recent data, might have the problems of unemployment and educational mismatch the most, which is bachelor degree level. To make sure that the sample we choose are comparably equivalent workers, this study take into account what Morikawa, M. (2016) did by setting criteria for the dataset. For example, using regular full-time employees, aged between 21 and 59, public sector workers are employed by the central or local government, but not limit the firm size of the sample in private sector like the literature did, because of the recently rise of the start-up companies, so every size of firms should be counted.

3. Data

This study using the secondary data sources from Thai Labor Force Survey (LFS) in the third quarter of 2022, which is requested from National Statistical Office.

4. Empirical Methods and Models

Empirical Methods

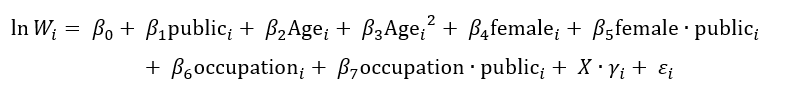

Using of Mincerian wage regression (Mincer, J. (1974)) to control for observed employee characteristics that would affect wages they earn, with a dummy variable indicating whether the employee is employed in the public sector or private sector. The equation is:

We also restrict the sample with four criteria, first education: only workers who have highest education level as bachelor’s degree are counted, second full-time workers: only workers

who have at least 35 hours of work per week are counted, third active workers: only workers who have age between 21 – 59 are counted, fourth occupations: only employed persons who worked as manager, professional, technician, clerical support worker and service worker are interpreted. After regression, the coefficient β1 will give the estimate of the private and public employees wage premium.

Empirical Models

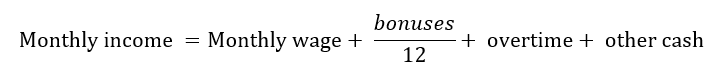

We have 3 models for this regression analysis with two difference bases in each model, the different is how we calculate monthly income for a person. The first base is using approximate monthly wages, but for the second base, apart from the data on basic wages we also included supplementary benefits received in cash, such as bonuses (in term of average per month), overtime (monthly) and other cash (monthly). Monthly income equation is:

5. Results

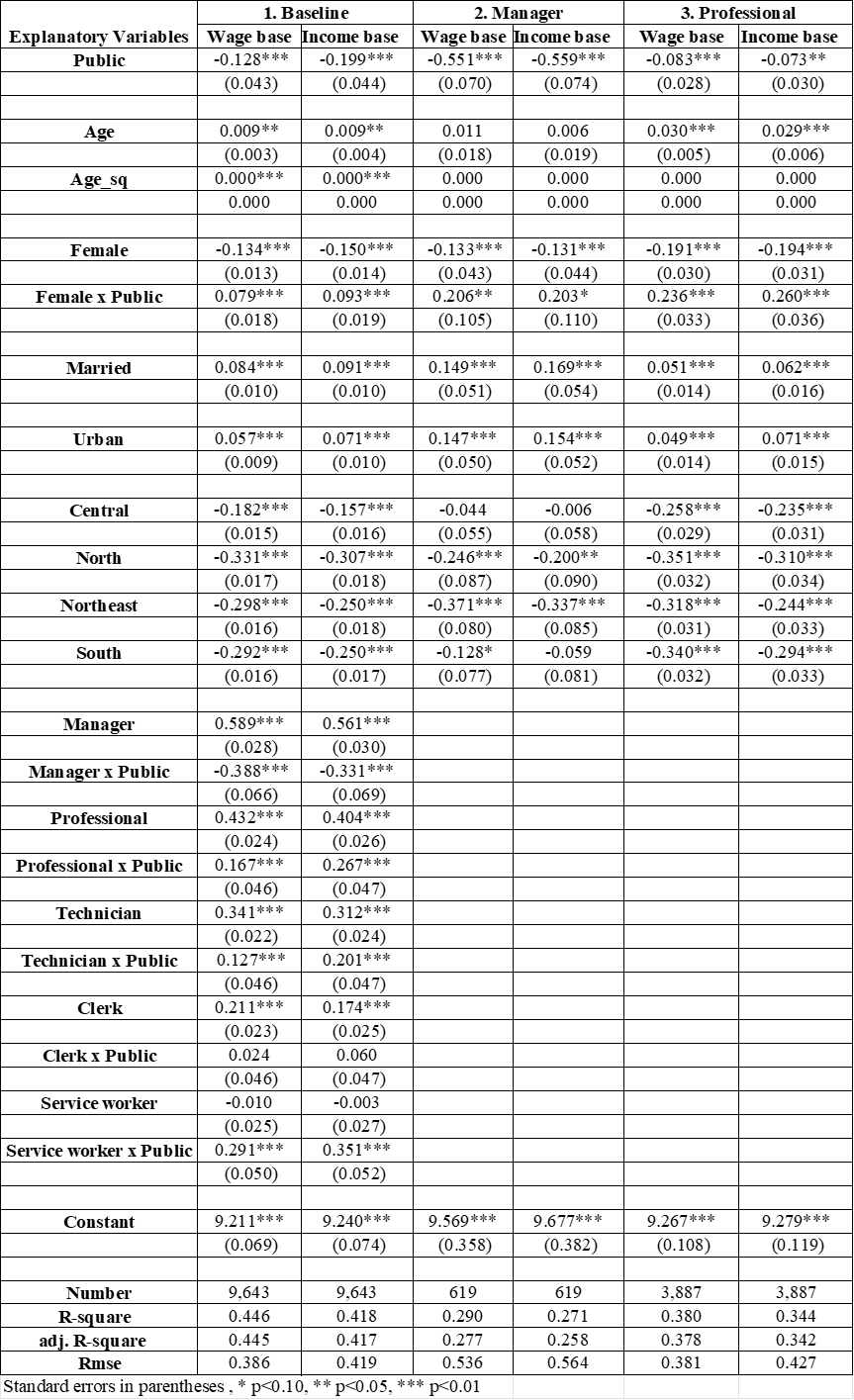

Premiums or discount by region

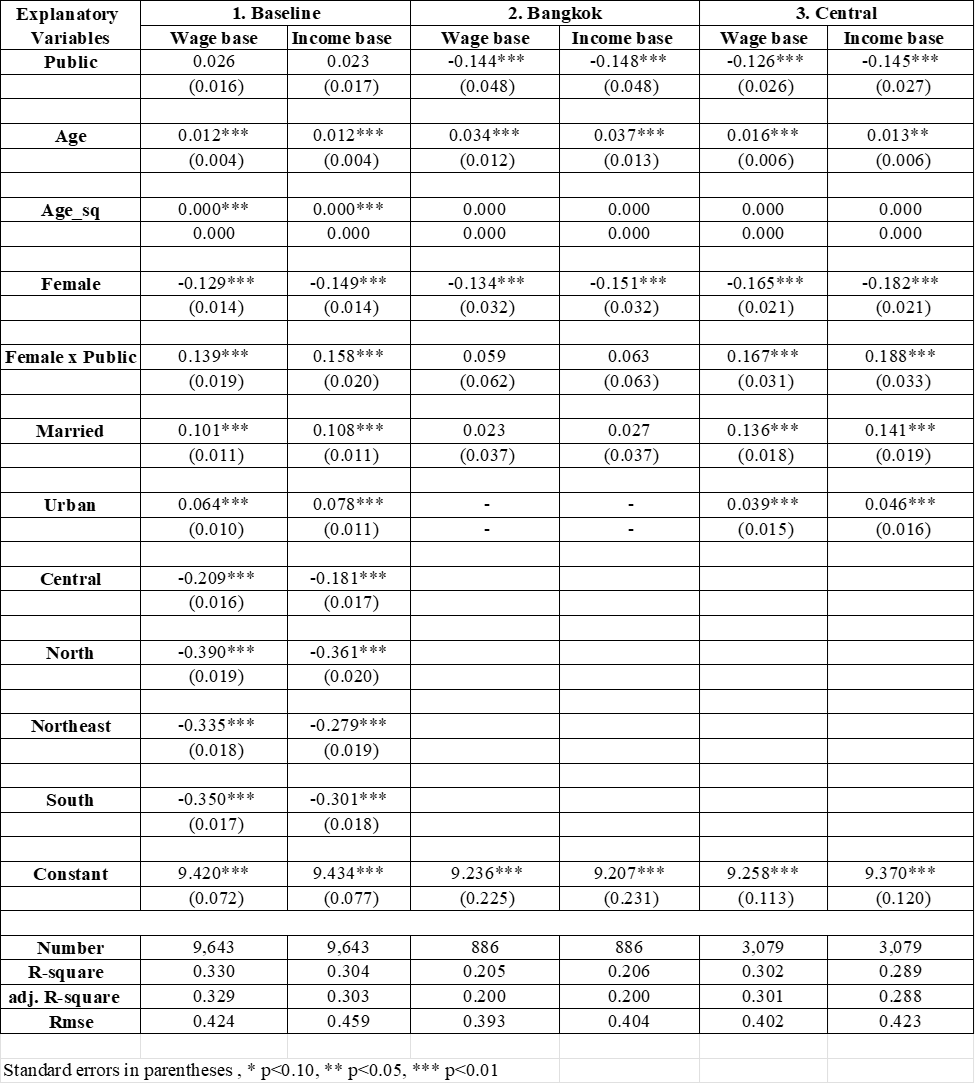

The estimation results of model 1 are presented in Table 1 both in wage base and income base. The size of the public sector wage premium or discount is different by region where employees live, namely column (2.) Bangkok -14.4% in term of wage and -14.8% in term of income, column (3.) Central -12.6% in term of wage and -14.5% in term of income, column (4.) North 8.3% in term of wage and 7.1% in term of income (not statistically significant), column (5.) Northeast 19.3% in term of wage and 18% in term of income and column (6.) South 21.6% in term of wage and 26.5% in term of income. This is showing that on average if they are public sector employee, they will have wage discount (negative sign) or wage premium (positive sign), for example if they are employee in Bangkok or Central, they will have a 14.5% – 14.8% wage discount on average for Bangkok, and will have a 12.6% – 14.5% wage discount on average for central, this is statistically significant at the 1% level. On the other hand, if they live in north, northeast or south they are likely to have wage premium, 7.1% – 8.3%, 18% – 19.3% and 21.6% – 26.5%, respectively, and this is statistically significant at the 1% level except for north region.

These results confirm the importance of regional effect on wages, in this case Bangkok is better off for private sector, because in Thailand most of the high-paying jobs across all career levels are concentrated in Bangkok. While for public sector, they are better off if they work in the south, northeast or north, respectively, as not much job distribution in the countryside from the private sector.

Table 1: Model 1 OLS Estimates of Equation with Robust Standard Error

Interpreted as a Percentage of Monthly Wage and Monthly Income

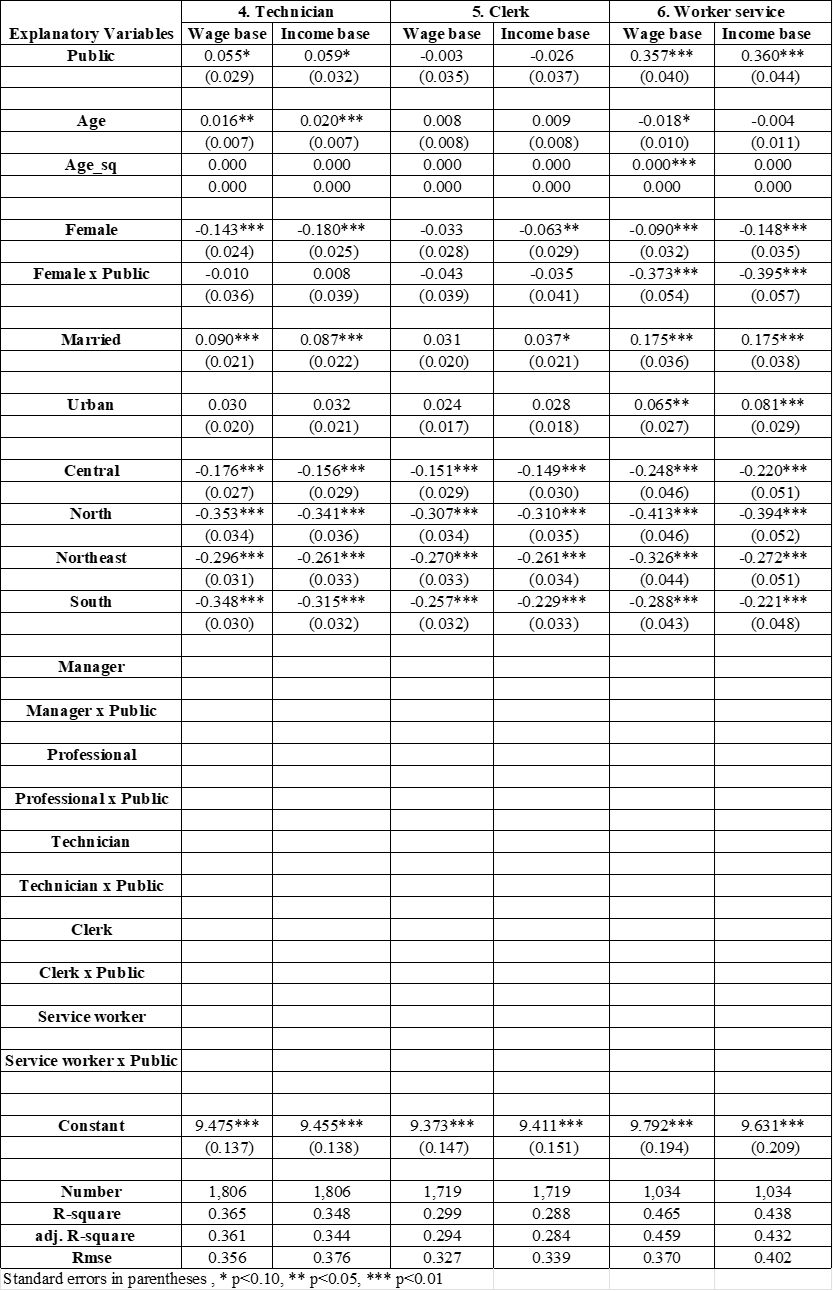

Premiums or discount by occupation

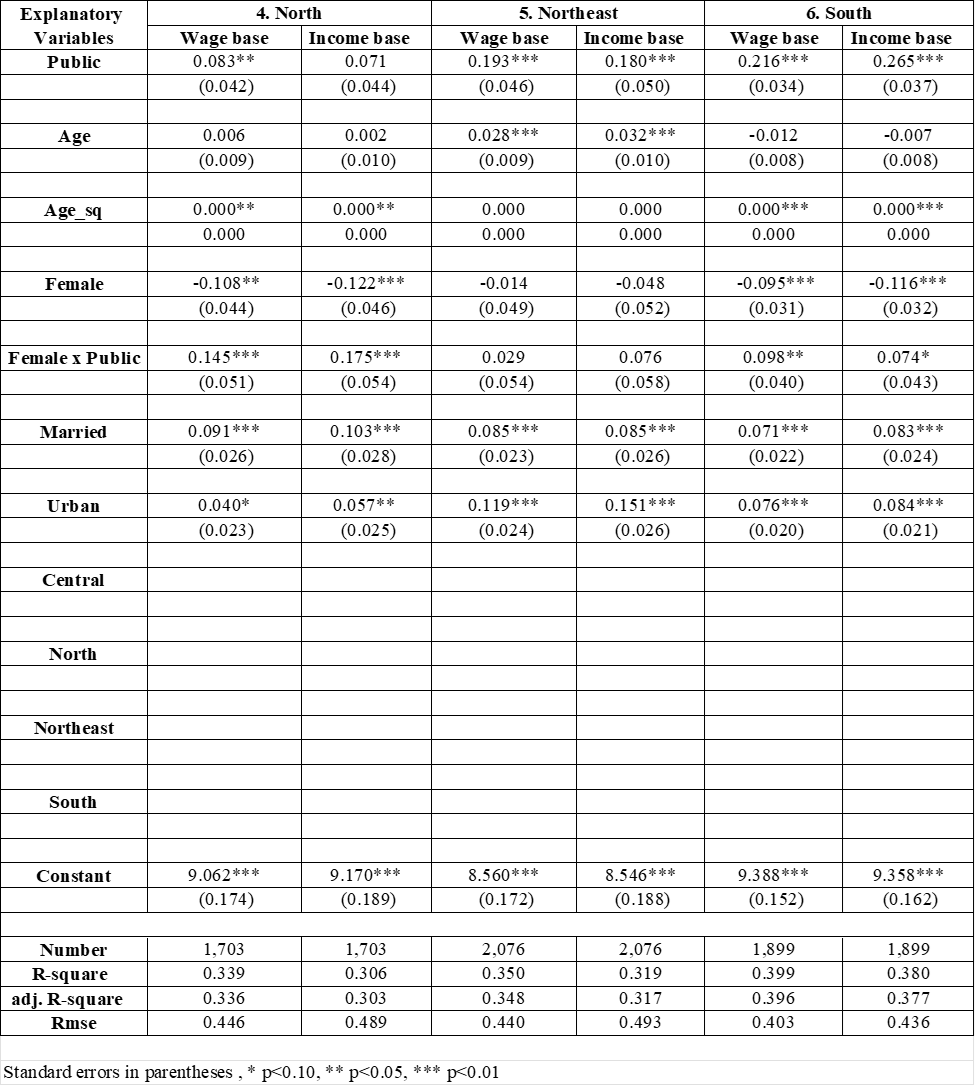

Now moving on to the model 2 that are presented in table 2, the results that shows in model 1 suggested us to control for region categorical variables as well. After controlling for gender, marital status, age, area, region and run each occupation in observations separately, in order to investigate in detail what group of occupation are better off if they work in public sector, now we have 6 equations as explained in empirical model section, and each one represents each occupation in major group that are classified as follows:

- Columns (1.) = Whole observations with each occupation dummies variable

- Columns (2.) = Legislators, senior government officials, executives and managers

- Columns (3.) = Professionals

- Columns (4.) = Technicians

- Columns (5.) = Clerks

- Columns (6.) = Services workers

When considering the coefficient for public dummy in baseline equation column (1.) from both wage base and income base, it’s quite clear that private sector employees are better off overall, as the public sector employees have wage discount on average 12.8% – 19.9% lower compare to private sector employees with the same qualification. But after separate observations by occupation in major group and run regression separately, the coefficients are different, namely column (2.) Manager, -55.1% in term of wage and -55.9% in term of income, column (3.) Professional, -8.3% in term of wage and -7.3% in term of income, column (4.) Technician, 5.5% in term of wage and 5.9% in term of income, column (5.) Clerk, -0.3% in term of wage and -2.6% in term of income (not statistically significant) and column (6.) Service worker, 35.7% in term of wage and 36% in term of income. This is implying that, if they are public sector employee in some occupation group, on average they will have wage discount (negative sign) or wage premium (positive sign) depending on which group they are in, for more explanation, if they work as legislators or senior government officials in public sector, they will have a 55.1% – 55.9% wage discount on average compare to executives or managers in private sector with the same qualification, this is statistically significant at the 1% level. The same go to professional and clerk group in public sector, as they will have a 7.3% – 8.3% and 0.3% – 2.6%, respectively, wage discount on average if they have the same qualification, this is statistically significant at the 1% level except for clerk group. Public sector employees have wage premium compare to private sector employees if they are technician (on average 5.5% – 5.9% higher) and service worker (on average 35.7% – 36% higher) with the same qualification, this is statistically significant at the 1% level for service worker group and 10% level for technician group.

Additionally, when we look into the male and female wage gap within sector, unsurprisingly, it’s by far smaller in the public sector compare to private sector counterpart, on average, the gender wage gap in public sector is around 5.5% – 5.7% lower for female, while the gap in private sector is around 13.4% – 15% lower for female. The reason behind these differences probably because of wage structure differential, given that public sector wage is determined by government regulations but not negotiation and discretion, this leading to lower level of discrimination against women in public sector. When we restrict the observation of both sector to those in each group of occupation separately, public sector female workers are better off compare to private sector if they are in manager and professional group, all of this could explain why the proportion of women in public sector is quite a lot.

Table 2: Model 2 OLS Estimates of Equation with Robust Standard Error

Interpreted as a Percentage of Monthly Wage and Monthly Income

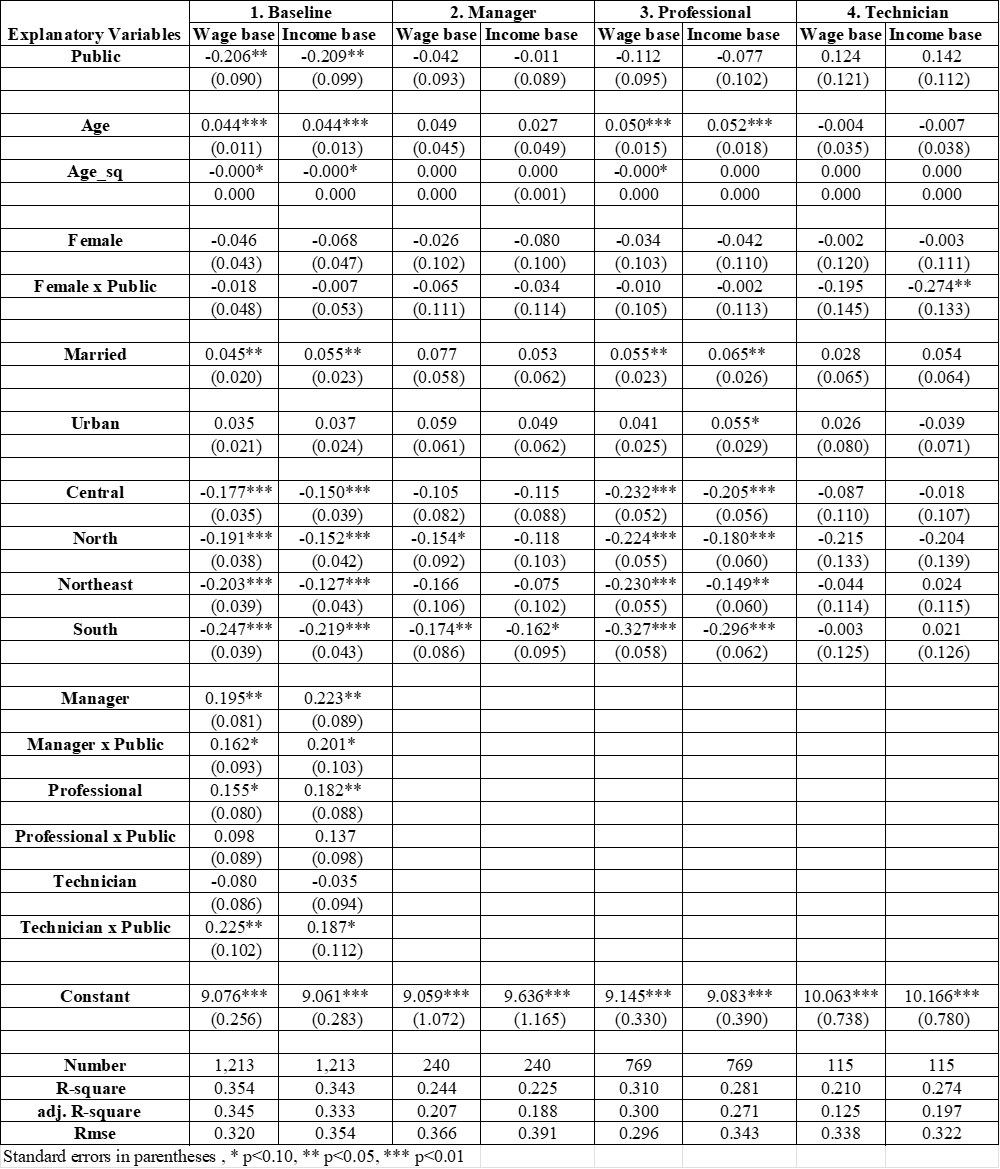

Furthermore, we want to investigate the effect of education attainment on wages, as our main observation in the first and second models are bachelor degree holders, but what if we look at the level above them, such as master degree holders and Ph.D. holders. We grouping master degree holders and Ph.D. holders together, while holding the other control variables constant, even though in this group we only have 1,213 observations.

The table 3 shows the results of individual characteristics that can impact wages, our variables of interest are job sectors (Public and Private) and occupation in major group (Manager/Professional/Technician). The other control variables are work experience, region of work, gender, area of household and marital status. When considering the coefficient for public dummy in baseline equation column (1.) from both wage base and income base, the sign is the same as model 2 result, but the size is bigger, as expected from the relationship of wage and education attainment. As a result, the public sector employees have wage discount on average 20.6% – 20.9% compare to private sector employees with the same qualification.

The table 3 shows the results of individual characteristics that can impact wages, our variables of interest are job sectors (Public and Private) and occupation in major group (Manager/Professional/Technician). The other control variables are work experience, region of work, gender, area of household and marital status. When considering the coefficient for public dummy in baseline equation column (1.) from both wage base and income base, the sign is the same as model 2 result, but the size is bigger, as expected from the relationship of wage and education attainment. As a result, the public sector employees have wage discount on average 20.6% – 20.9% compare to private sector employees with the same qualification.

Table 3: Model 3 OLS Estimates of Equation of higher than bachelor degree education level Interpreted as a Percentage of Monthly Wage and Monthly Income

6.Conclusion

A wage premium is a higher wage rate earned by employees in a specific job or profession relative to the wages of other similar workers, while wage discount is the opposite, in case of this study, we add to literature review by focusing on public and private employees who hold the same highest education as bachelor’s degree with related to region, gender and occupation in major group of the workers, not surprisingly their earnings are on average lower in public sector for both gender compare to private sector, so in Thailand we have wage discount in public sector.

To explain more, the results summation can be explained as follow: First, for regional wage differentials, private sector has wage premium if they work in Bangkok and central region, while public sector will have the premium if they work in north, northeast and south region, moreover the premium will be higher if they work in urban area. Second, for occupation in major group wage differentials, the higher the job position they are in workplace, the higher chance the premium will shift from public sector to private sector, for example, public sector employee who are technician and service worker will have wage premium, but private sector employee who are manager and professional will have wage premium as it’s high rank position, similar to the previous studies. Third, for gender wage gap, the gap is by far smaller in the public sector compare to private sector counterpart, this is likely because of the problem of gender discrimination is less in public sector, due to wage regulations. There is not much difference between men and women (roughly 5.5% – 5.7%) but it’s is relatively high in private sector which women earn roughly 13.4% – 15% lower compare to men, this is probably because of type of jobs difference of men and women and also the problem of gender discrimination is more in private sector. Finally, when take into account supplementary benefits received in cash such as bonuses, overtime and other cash, it could make size of wage discount for public sector bigger, as the proportion of the employees in the private sector received supplementary benefits was higher than those in public sector.

However, when we consider the premium for public sector, it is likely to be higher than this estimation alone given that the public sector offers more benefits in term of welfare than the private sector, and these results do not factor in those non‐pecuniary features of employment, for example job security, health-care benefits, disability insurance and old-age pension. That are also factors that make some workers in favor of the public sector.

7. References

- Mincer, J. (1974). Schooling, Experience, and Earnings. New York: Columbia University

Press. - Chandoevwit, W. (2011) “Is It Always True That Government Employees Earn Less Than Private Sector Employees?” TDRI Quarterly Review, 26(3), pp. 3–9.

- Abadie, A. and Imbens, G. (2002) “Simple and bias-corrected matching estimators for average treatment effects.” Department of Economics, University of California, Berkeley.

- Abadie, A. et al. (2004) “Implementing matching estimators for average treatment effects in stata,” The Stata Journal: Promoting communications on statistics and Stata, 4(3), pp. 290–311.

- Morikawa, M. (2016) “A comparison of the wage structure between the public and private sectors in Japan,” Journal of the Japanese and International Economies, 39, pp. 73–90.

- Bender, K.A. (2002) “The central government-private sector wage differential,” Journal of Economic Surveys, 12(2), pp. 177–220.

- Paweenawat, S.W. And Vechbanyongratana, J. (2015) “Wage Consequences Of Rapid Tertiary Education Expansion In A Developing Economy: The Case Of Thailand,” The Developing Economies, 53(3), pp. 218–231

- Gindling, T. H., Hasnain, Z., Newhouse, D., & Shi, R. (2020). Are public sector workers in developing countries overpaid? Evidence from a new global dataset. World Development, 126, 104737.

Atit Saerepaiboonsub

author